Chart Of Accounts¶

A Chart of Accounts is the basic requirement of any accounting system. This is hierarchical in nature and is a combination of Account Groups, Account Heads and Account Types. It is very important to understand the correlation between all these three elements. We will explain in detail each of the elements and then the correlation between them.

Account Group¶

A group of accounts that need to be presented together and represented hiearchically can be achieved by creating Account Groups. The following are account groups at the basic level with their legends.

| Legend | Account Group | Group Type |

|---|---|---|

| A | Assets | Balance Sheet |

| O | Owner’s Funds | Balance Sheet |

| L | Liabilities | Balance Sheet |

| I | Income | Profit & Loss |

| C | Cost of Goods Consumed | Profit & Loss |

| E | Expenses | Profit & Loss |

| P | P&L Appropriations | Profit & Loss (Below the line) |

The first three groups, namely Assets, Owner’s Funds, Liabilities are groups whose balances would be carried forward at the end of the Fiscal/Financial Year. Meaning, any Account Head created within these groups or any of their child groups would become part of the Balance Sheet and treated accordingly for carry forward of balances from one Fiscal Year to another.

The rest of the groups, Income, Cost of Goods Consumed, Expenses, P&L Appropriations would be closed at the end of the Fiscal/Financial Year and transferred to the Profit & Loss Account. Only the net profit/loss would be carried forward to the Balance Sheet.

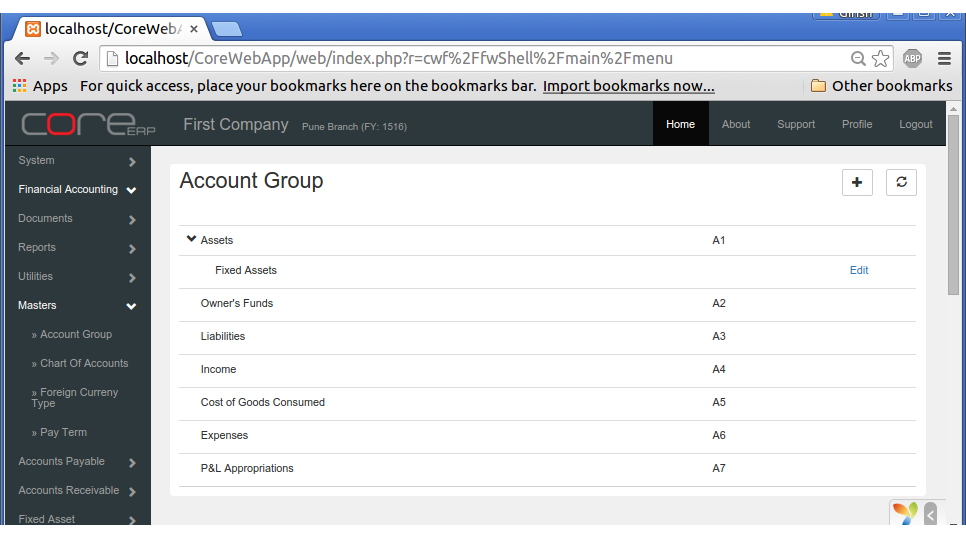

These are the root groups in the Chart Of Accounts. You cannot add or edit any of these groups. Any new group created must belong to one of these groups.

Click on the menu Financial Accounting -> Masters -> Account Group.

The following screen should appear.

You can create a new group by clicking on +.

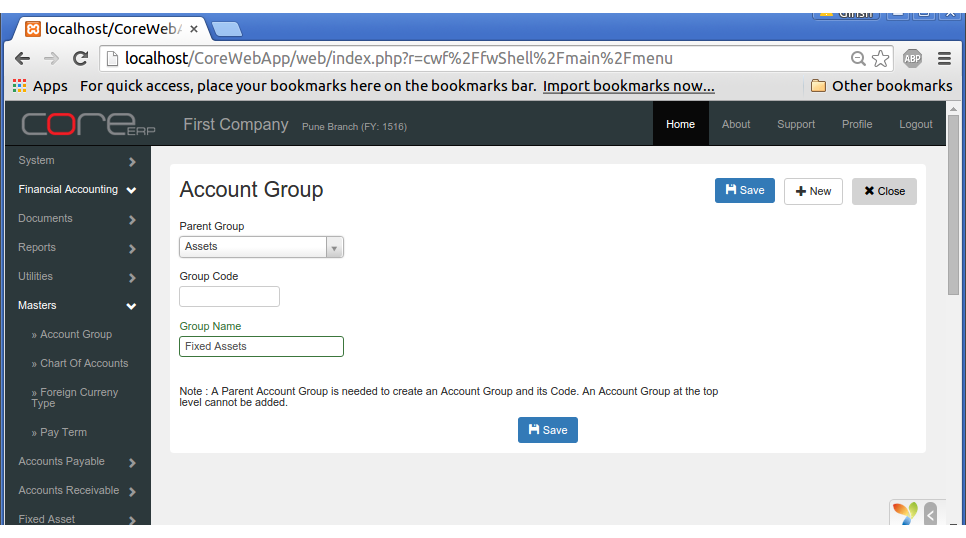

Since Account Group follows a parent-child hierarchy, you need to select a parent group and mention the group name for the newly created group.

An example group called Fixed Assets created under the parent Assets would appear as follows:

The fields are explained in the following table:

| Field Name | Required | Description |

|---|---|---|

| Parent Group | Yes | Select an already existing group |

| Group Code | No | This is an optional code of 10 alphabets |

| Group Name | Yes | The Group Name to be created or edited |

Click on  to save your changes and close. The Group chart will now display the newly created group inside the parent group.

to save your changes and close. The Group chart will now display the newly created group inside the parent group.

You can create any number of groups at any level except for the root level.

Account Head¶

An Account head represents a ledger which records all transactions within it. An Account Head’s behaviour is driven by the Account Type that you select while creating an Account Head. Each Account Type has a specific treatment attributed to it in CoreERP. It is therefore very important to understand the implications of creating an Account Head of the particular Account Type. Once an account of a particular type is created, the type of that account cannot be altered.

An Account Head can only be created in one of the Account Groups. The Account Head would inherit the attributes of the top most parent group. e.g. An Account head created inside Assets (at any level) would always be balanced at the end of the financial year and the closing balance is carried forward to the next financial year.

Let us now understand various Account Types and their usage when creating a new Account head.

| Code | Account Type | Group Usage | Txn. Type | Explanation |

|---|---|---|---|---|

| 1 | Bank | A, L | U | All types of Bank Accounts except Fixed Deposits. |

| 2 | Cash | A | U | Cash Accounts including petty cash |

| 3 | Others - Generic | A, O, L, I, E | U | Accounts not of any other specific type. This is the most generic in nature |

| 6 | Inventories | A | S | Inventory Accounts that can be associated with Stock Items for inventory valuation |

| 7 | Debtors | A | S | This is hidden and used by the system to create Customers |

| 9 | Capital | O | U | Could be Share Capital, Capital Fund, etc. |

| 12 | Creditors | L | S | This is hidden and used by the system to create Suppliers |

| 13 | Other Liabilities | L | U | Can be used for Landed Cost in Stock Purchase |

| 15 | Retained Earnings | O | U | Used for Carry Forward of Balances (automated adjustments) |

| 16 | Fixed Assets | A | S | Accounts associated to Asset Class for Fixed Assets |

| 18 | Sales | I | U | Sales Accounts for Stock Invoice |

| 21 | Direct Expenses | C | U | Accounts that can be used for booking direct expenses |

| 22 | Indirect Expenses | E | U | Accounts that can be used for booking all other expenses |

| 23 | Direct Income | I | U | Income Accounts Service Invoice |

| 25 | Inventory Consumption | C | S | Inventory Accounts that can be associated with Stock Items for inventory consumption |

| 30 | Profit & Loss A/c | L | U, S | P/L adjustments for the Fiscal Year |

| 42 | Depreciation | E | S | Accounts associated to Asset Class for depreciation |

| 43 | Accumulated Depreciation | A | S | Accounts associated to Asset Class for Accumulated Depreciation |

| 44 | TDS Payable (Other Liability) | L | S | Association for Tax Deduction/witholding |

| 45 | Inter Branch | A, L | S | Control A/c - used for Inter-branch transactions |

| 46 | Bills Receivable Control | A | S | Control A/c - Used for representing Customers in Trial Balance |

| 47 | Bills Payable Control | L | S Control A/c - Used for representing Suppliers in Trial Balance | |

- Txn. Type Legends

- U : User transactions allowed

- S : System would post automatic transactions. user Transactions are not allowed

Association with various Documents¶

- Financial Accounting

- Bank Payment

- Header | 1 Line Items | 3, 9, 13, 21, 22

- Bank Recipt

- Header | 1 Line Items | 3, 9, 13, 21, 22

- Cash Payment

- Header | 2 Line Items | 3, 9, 13, 21, 22

- Cash Receipt

- Header | 2 Line Items | 3, 9, 13, 21, 22