GST Setup Guide¶

This guide provides the basic guidelines required to be followed and setup GST in CoreERP.

GL Interface for GST¶

We will first start by setting up the following accounts in the Chart Of Accounts. You are required to have add/edit rights to Financial Accounting -> Chart Of Accounts.

Create the following accounts for Input Tax Credit purposes

| Account Group | Account Type | Account Head |

|---|---|---|

| Assets -> Current Assets | Other Assets | SGST Input Credit |

| Assets -> Current Assets | Other Assets | CGST Input Credit |

| Assets -> Current Assets | Other Assets | IGST Input Credit |

| Assets -> Current Assets | Other Assets | CESS on GST Input Credit |

Create the following accounts for recording Tax Collections

| Account Group | Account Type | Account Head |

|---|---|---|

| Liabilities -> Current Liabilities | Other Liabilities | SGST Collected |

| Liabilities -> Current Liabilities | Other Liabilities | CGST Collected |

| Liabilities -> Current Liabilities | Other Liabilities | IGST Collected |

| Liabilities -> Current Liabilities | Other Liabilities | CESS on GST Collected |

Create the following accounts for recording Tax Liability on Reverse Charge

| Account Group | Account Type | Account Head |

|---|---|---|

| Liabilities -> Current Liabilities | Other Liabilities | SGST Payable On Reverse Charge |

| Liabilities -> Current Liabilities | Other Liabilities | CGST Payable On Reverse Charge |

| Liabilities -> Current Liabilities | Other Liabilities | IGST Payable On Reverse Charge |

| Liabilities -> Current Liabilities | Other Liabilities | GST CESS Payable On Reverse Charge |

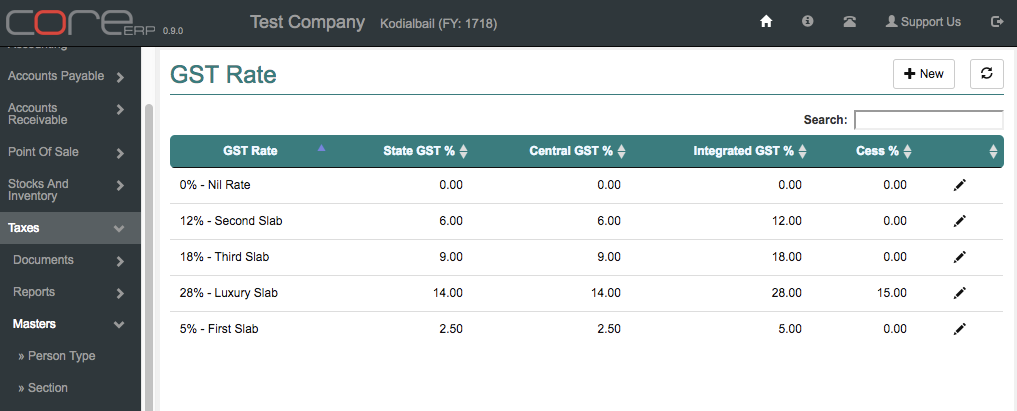

Create GST Rates¶

Presently there are 4 GST rates and one Nil rate. Click on Taxes -> Masters -> GST Rate

Create the following rates based on current GST rate. This may change over time and new rates can be created similarly.

GST Rate is 0% Nil Rate

| Rate Type | Percentage | Input Tax Credit A/C | Tax Collection A/C | Reverse Charge Liability |

|---|---|---|---|---|

| SGST | 0.00 | SGST Input Credit | SGST Collected | SGST Payable On Reverse Charge |

| CGST | 0.00 | CGST Input Credit | CGST Collected | CGST Payable On Reverse Charge |

| IGST | 0.00 | IGST Input Credit | IGST Collected | IGST Payable On Reverse Charge |

| Cess | 0.00 | CESS on GST Input Credit | CESS on GST Collected | GST CESS Payable On Reverse Charge |

GST Rate is 5% First Slab

| Rate Type | Percentage | Input Tax Credit A/C | Tax Collection A/C | Reverse Charge Liability |

|---|---|---|---|---|

| SGST | 2.50 | SGST Input Credit | SGST Collected | SGST Payable On Reverse Charge |

| CGST | 2.50 | CGST Input Credit | CGST Collected | CGST Payable On Reverse Charge |

| IGST | 5.00 | IGST Input Credit | IGST Collected | IGST Payable On Reverse Charge |

| Cess | 0.00 | CESS on GST Input Credit | CESS on GST Collected | GST CESS Payable On Reverse Charge |

GST Rate is 12% Second Slab

| Rate Type | Percentage | Input Tax Credit A/C | Tax Collection A/C | Reverse Charge Liability |

|---|---|---|---|---|

| SGST | 6.00 | SGST Input Credit | SGST Collected | SGST Payable On Reverse Charge |

| CGST | 6.00 | CGST Input Credit | CGST Collected | CGST Payable On Reverse Charge |

| IGST | 12.00 | IGST Input Credit | IGST Collected | IGST Payable On Reverse Charge |

| Cess | 0.00 | CESS on GST Input Credit | CESS on GST Collected | GST CESS Payable On Reverse Charge |

GST Rate is 18% Third Slab

| Rate Type | Percentage | Input Tax Credit A/C | Tax Collection A/C | Reverse Charge Liability |

|---|---|---|---|---|

| SGST | 9.00 | SGST Input Credit | SGST Collected | SGST Payable On Reverse Charge |

| CGST | 9.00 | CGST Input Credit | CGST Collected | CGST Payable On Reverse Charge |

| IGST | 18.00 | IGST Input Credit | IGST Collected | IGST Payable On Reverse Charge |

| Cess | 0.00 | CESS on GST Input Credit | CESS on GST Collected | GST CESS Payable On Reverse Charge |

GST Rate is 28% Luxury Slab

| Rate Type | Percentage | Input Tax Credit A/C | Tax Collection A/C | Reverse Charge Liability |

|---|---|---|---|---|

| SGST | 14.00 | SGST Input Credit | SGST Collected | SGST Payable On Reverse Charge |

| CGST | 14.00 | CGST Input Credit | CGST Collected | CGST Payable On Reverse Charge |

| IGST | 28.00 | IGST Input Credit | IGST Collected | IGST Payable On Reverse Charge |

| Cess | 0.00 | CESS on GST Input Credit | CESS on GST Collected | GST CESS Payable On Reverse Charge |

You may add more slabs based on your requirements and map it to the ledgers accordingly.

It should look like this

Associate GST Rates with HSN/SAC¶

This is the final step for GST setup. Here we use the menu Taxes -> Masters -> HSN Rate. Here, you would find a list of HSN codes available via the GSTN API. To utilise any of these HSN/SAC codes, a GST Rate is required to be associated.

Proceed to select the specific HSN code as per the chapter heading of your product and associate the GST Rate.